latest in Alts-Align

Proxy Technology is Important

FEV's benchmarking technology not only automates proxy construction for each holding, it also optimizes their stability and specificity to prevent unwarranted transfer of volatility into the NAV estimation process. Proxy technology makes an important contribution to the reliability of NAV estimation.

Operational edge from intelligent valuation.

clarity during volatility

Alts-Align is proven reliably accurate, even during high market volatility. Step up valuation frequency for liquidity and other operational processes as needed.

Responsiveness

Help your team respond efficiently to investment opportunities and stakeholder requests. Refresh fund-level valuation and returns measurement systematically, when you need.

product differentiation

Tailor your investment products with rigor and granularity. Unitize even at the fund level and analyze through-fund (e.g., industry exposures), using Alts-Align’s powerful data framework.

Powerful, Audit-Friendly Now-Cast

NAV Engine

Alts-Align

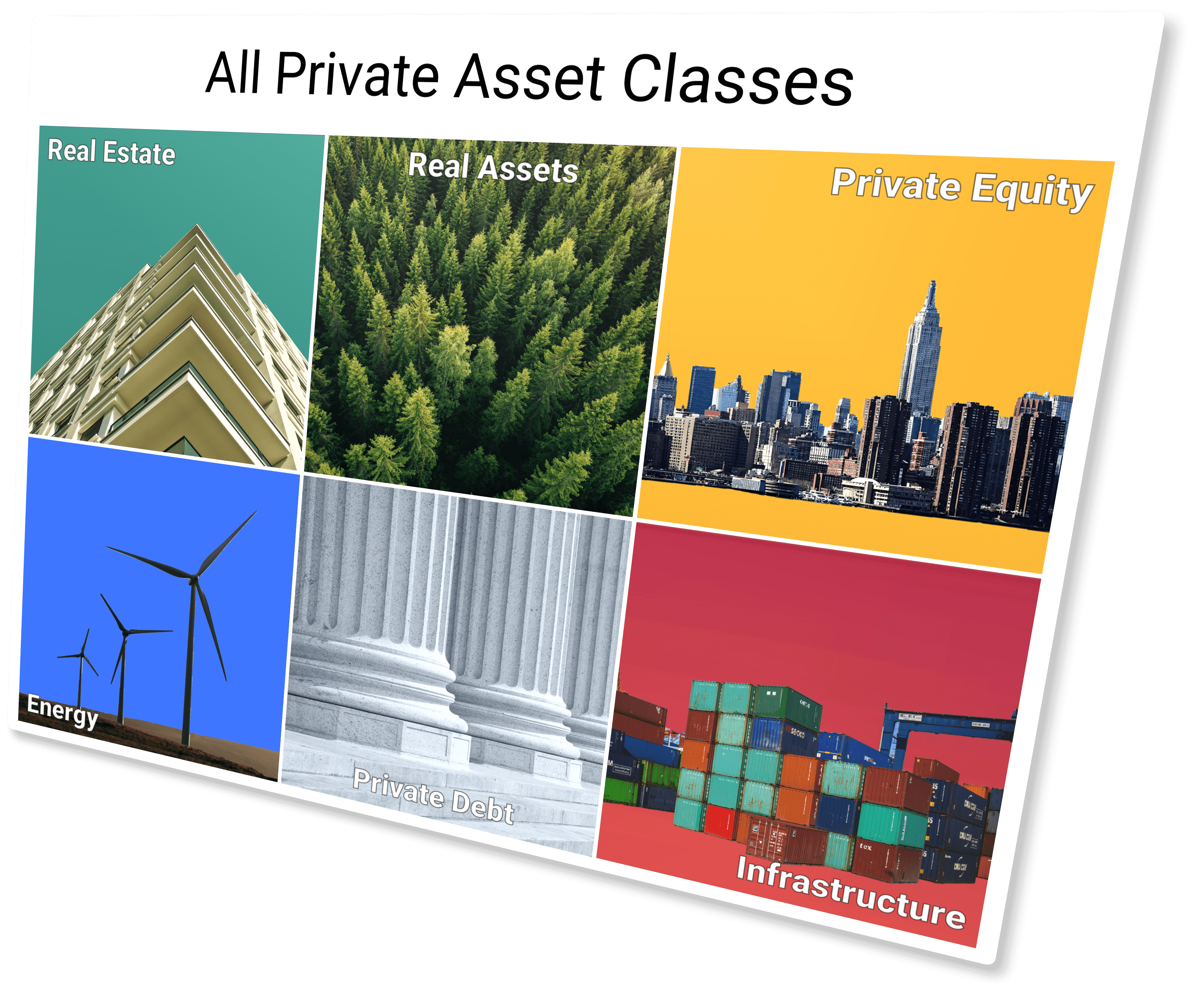

Unifies valuation across asset classes for operational edge.

Powerful differentiators deliver industry-leading

accuracy, speed, and reliability

to NAV estimation.

accuracy, speed, and reliability

to NAV estimation.

market returns component

Methodology consistently outperforms coarse indexing and adds rich context to daily outputs.

consistency

Automated process simultaneously removes human inconsistency and responds intelligently to the market.

quality framework

ISO compliant continuous improvement maintains reliability and accuracy as your portfolio and conditions evolve.

holdings level

Data framework goes all the way to the security type for accuracy and transparency of valuation.

Powerful differentiators deliver industry-leading

accuracy, speed, and reliability

to NAV estimation.

accuracy, speed, and reliability

to NAV estimation.

Methodology consistently outperforms coarse indexing and adds rich context to daily outputs.

Automated process simultaneously removes methodological inconsistency and responds intelligently to the market.

ISO compliant continuous improvement maintains reliability and accuracy as your portfolio and conditions evolve.

Data framework accommodates all the way to the security type for accuracy and transparency of valuation.

Manage with absolute clarity

Scale up responsiveness and enhance operational processes with valuation frequency of your choosing:

- Quarterly

- Monthly

- Weekly

- Daily

Activate modular add-on solutions when you need them, and evolve along with your client and stakeholder needs:

- Contemporaneous portfolio valuation

- Responsive portfolio analytics

- True-up

- Daily forward pricing

- Exit valuation

Ground-breaking R&D continuously improves all performance aspects:

- Valuation science

- Data flow

- Compliance

- Technology optimization

Manage with absolute clarity

Scale up responsiveness and enhance operational processes with the valuation frequency of your choosing:

- Quarterly

- Monthly

- Weekly

- Daily

Activate modular add-on solutions when you want:

- Portfolio analytics

- Liquidity

- Daily forward pricing.

- Exit valuation

Ground-breaking R&D continuously improves all performance aspects:

- Valuation science

- Data flow

- Compliance

- Technology optimization.

'Data science good value for investors.'

'FEV's innovation in valuation

paves the way for fee structure innovation.'

paves the way for fee structure innovation.'

'FEV's innovation in valuation paves the way for fee structure innovation.'

'Data science good value for investors.'

'Paves the way for fee structure innovation.'

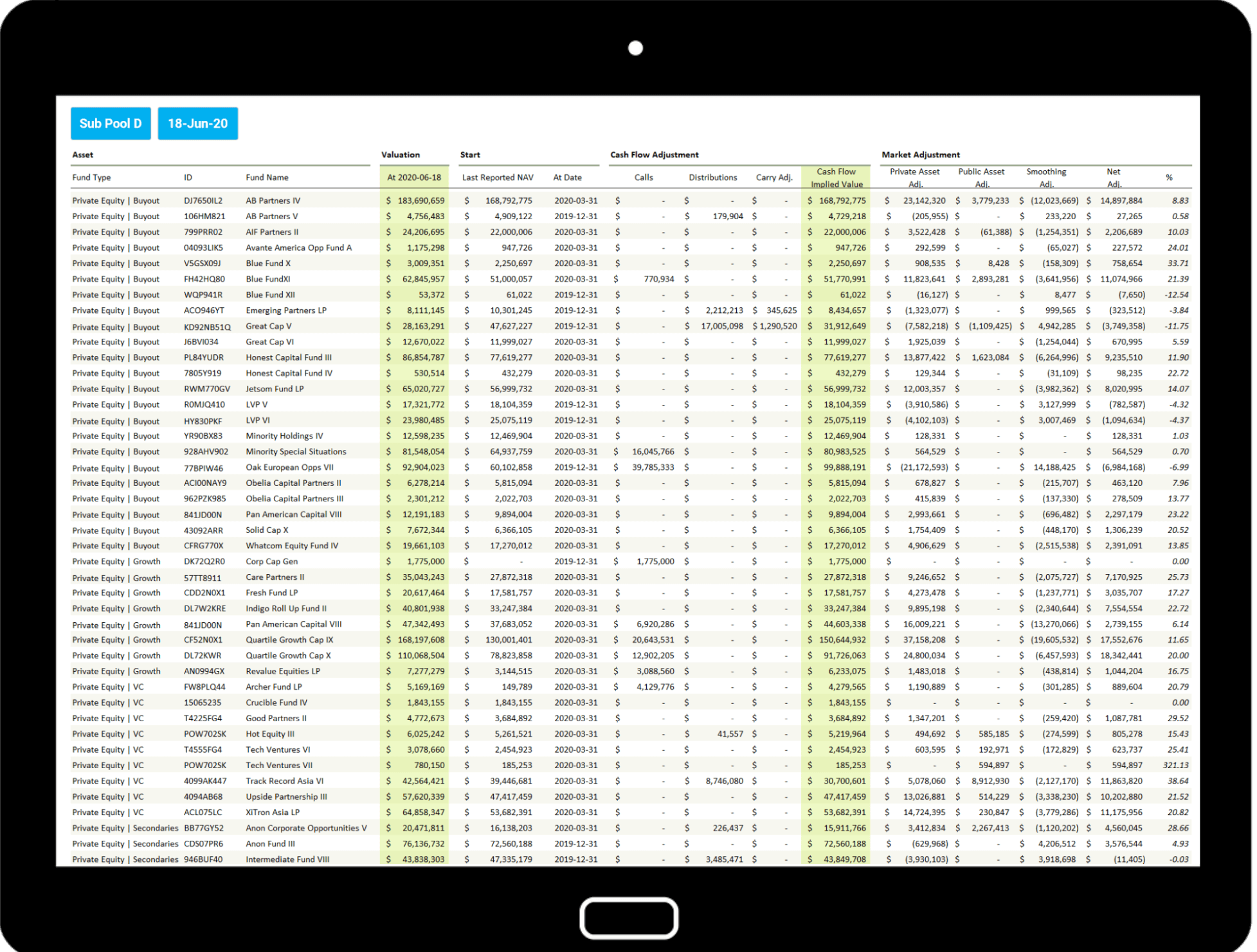

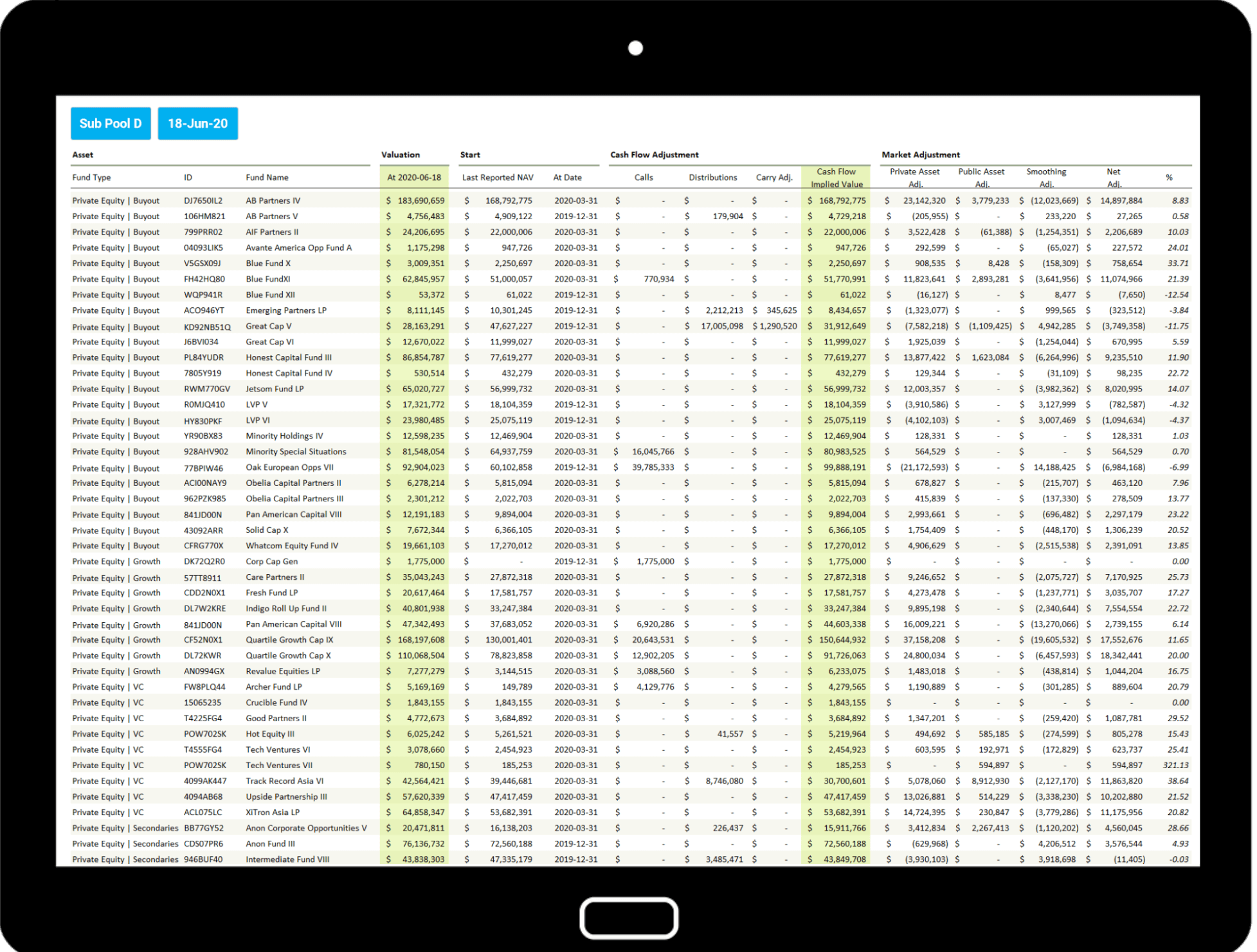

Drill Down

Alts-Align provides detailed valuation traceability of each asset, every valuation run. Drill down to a specific asset, on a specific date, to a specific component of the valuation procedure. Intra-procedural quantities split out and step through the major components of the valuation methodology. Assign and transfer assets, price pools, fine tune liquidity algorithms with the rich context and full transparency provided by Alts-Align.

explicitly targets gp nav

⤸

⤸

public holdings valued separately

⤸

⤸

raw & smoothed market returns ⤹

full granularity

to specifiable date

⤹

to specifiable date

⤹

returns modeled by security type

(e.g. equity, royalty, off-take, warrant, etc.)

for enhanced accuracy

⤸

(e.g. equity, royalty, off-take, warrant, etc.)

for enhanced accuracy

⤸

Drill Down

Alts-Align provides detailed valuation traceability of each asset, every valuation run.

Drill down to a specific asset, on a specific date, to a specific component of the valuation procedure.

Intra-procedural quantities split out and step through the major components of the valuation methodology.

Assign assets, price pools, fine tune liquidity algorithms with rich context and daily transparency.

Drill down to a specific asset, on a specific date, to a specific component of the valuation procedure.

Intra-procedural quantities split out and step through the major components of the valuation methodology.

Assign assets, price pools, fine tune liquidity algorithms with rich context and daily transparency.

explicitly targets gp nav

⤸

⤸

public holdings valued separately

⤸

⤸

raw & smoothed market returns

⤹

⤹

full granularity

to specifiable date

⤹

to specifiable date

⤹

returns modeled by security type (e.g. warrant) for enhanced accuracy

⤸

⤸

built right, on a foundation of data science

➀ Coherent data identity system

➁ Intelligent data framework, adaptive to your data

➂ Data automation

➁ Intelligent data framework, adaptive to your data

➂ Data automation

...for enhanced operational responsiveness

Equip your team with a rolling pro forma NAV that includes rich multi-dimensional views on valuation:

- Routine quality exercise of data inputs

- Multiple designated pools (e.g. products, apportioned holdings)

- Asset allocations (e.g. sub-class, security type)

- Thematic aggregations (e.g. ESG, mandates)

beginning with the right building blocks

➀ Coherent data identity system

➁ Intelligent data framework, adaptive to your data

➂ Data automation

➁ Intelligent data framework, adaptive to your data

➂ Data automation

...for enhanced operational responsiveness

Equip your team with a rolling pro forma NAV that includes rich multi-dimensional views on valuation:

- Routine quality exercise of data inputs

- Multiple designated pools (e.g. products, apportioned holdings)

- Asset allocations (e.g. sub-class, security type)

- Thematic aggregations (e.g. ESG, mandates)

beginning with the right building blocks

➀ Coherent data identity system

➁ Intelligent data framework, adaptive to your data

➂ Data automation

➁ Intelligent data framework, adaptive to your data

➂ Data automation

...for enhanced

operational responsiveness

operational responsiveness

Equip your team with a rolling pro forma NAV that includes rich multi-dimensional views on valuation:

- Codified data quality exercise

- Multiple designated pools

e.g. products, apportioned holdings

- Asset allocations

e.g. sub-class, security type, strategy

- Thematic aggregations

e.g. ESG, mandates

Valuation

explicitly targeting subsequently reported GP NAV