Trusted by the World's Leading Private Asset Management Teams

join the private market's

measurement revolution

operational edge

Remove Reporting Lag

Unite performance reporting across public and private asset classes, and optimize whole portfolio liquidity and risk.

expanded access

Alts-Inclusive Investment Products

Daily traded retirement plans can now offer private asset investment options valued with rigor, fairness, and no loss of diversification effect.

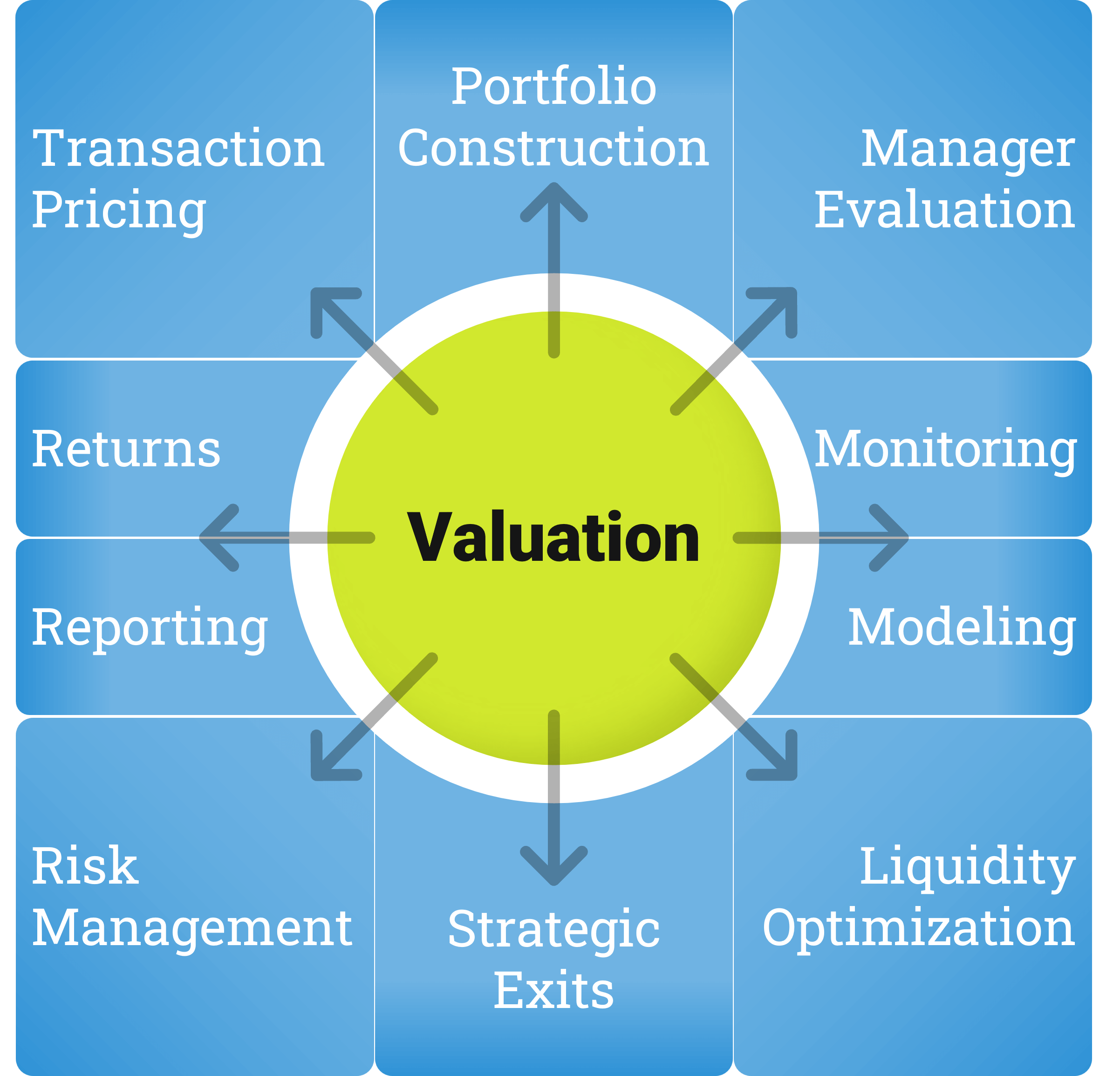

Valuation informs all that you do.

performance clarity

Apples-to-Apples Comparability

Disambiguate performance and outperformance at all levels with repeatable, time-weighted measures.

lower costs

Audit-Friendly Automation

Enhance the scope, speed, and reliability of your service levels, core analytical processes, and fiduciary oversight without budget bloat.

scalable, explicitly targeted, & far more useful

valuation intelligence

for all private asset investors

for asset owners

Institutional Limited Partner investors such as endowments, SWFs, and pension funds.

For Asset Managers

Primary and secondary General Partner managers of funds and fund-of-funds.

For Investment Advisors

Designated fiduciaries, RIAs, and consultants to DC pension plans, family offices, etc.

For DC Plan Sponsors

Defined contribution savings plans with private assets and daily trading.

case

study

FEV Analytics and UC Investments tested the impact of innovative holdings level proxies on its quarterly 'real-time' portfolio valuation.

Innovation In Valuation to Unlock 'Real Time' Portfolio Valuation

all private asset types

Read the Case Study

Alts-Align Real-Time NAV Service

What We Do

We make valuation

scalable, explicitly targeted,

and far more useful.

scalable, explicitly targeted,

and far more useful.

Breakthrough Technical Properties

Our Products

Alts-Align™

Portfolio Valuation Solutions

- Configurable frequency (up to daily)

- Reliable accuracy

- Eliminates reporting lag from portfolio ops

Go to Alts-Align

OPX™

Exit Value Solutions

- Accuracy to exit value [R2=0.87]

- Fine tunes inputs to liquidity algorithms

- Quantifies manager contribution to returns

More Game-Changing Capabilities

Valuation made

scalable, explicitly targeted,

and far more useful.

scalable, explicitly targeted,

and far more useful.

Alts-Align™

Portfolio Valuation Solutions

- Configurable frequency (up to daily)

- Reliable accuracy

- Eliminates reporting lag from portfolio operations

Go to Alts-Align

OPX™

Exit Value Solutions

- Accuracy to exit value [R2=0.87]

- Fine tunes inputs to liquidity algorithms

- Quantifies manager contribution to returns

More Game-Changing Capabilities

Daily Valuation of Illiquid Portfolios

in

DC Retirement Savings Plans

Managed Solutions that Codify the Mutual Fund Experience

Consistent

valuation process

valuation process

Overnight

NAV construction

NAV construction

Traceability

of NAV components

of NAV components

Protection

from dilutive effects

from dilutive effects

Flexible

product configuration

product configuration

The world's only comprehensive solution to the unique operational challenges of private asset portfolios in

defined contribution retirement products.

defined contribution retirement products.

Daily Forward Pricing

The core valuation process is reliably 3 hours or less, and systematically incorporates same-day market information, systematic true-ups to reported NAVs, cash flows, swing adjustments, and all known data.

NAV Accuracy

Entire solution is managed on a continuous improvement footing, reliably estimating to within 50bps of subsequently-reported GP NAVs at the portfolio level.

All Alts Coverage

Scope spans Real Estate, Energy, Infrastructure, Private Equity, and various security types, e.g. equity, royalties, offtakes, etc. Models are adjusted based on asset type and observed valuation behavior.

Easy Implementation

Alts-Align for DC is a turn-key managed service that plugs into your existing data flow, even spreadsheets, and requires no software installation. Under configured service levels, outputs are returned as simple additive quantities.

Daily Valuation

of

Illiquid Portfolios

of

Illiquid Portfolios

The world's only comprehensive solution to the unique operational challenges of private asset portfolios in

defined contribution retirement products.

defined contribution retirement products.

State-of-the-Art Valuation Technologies

Codify the Mutual Fund Experience

Codify the Mutual Fund Experience

Consistent

valuation process

valuation process

Overnight

NAV construction

NAV construction

Traceability

of NAV components

of NAV components

Protection

from dilutive effects

from dilutive effects

Daily

forward pricing

forward pricing

Flexible

product configuration

product configuration

Accurate

NAV estimation

NAV estimation

Coverage

across all alts

across all alts

Easy

implementation

implementation

Rigorous

product back testing

product back testing

more operational benefits

Alts-Align™ for Asset Managers and

DC Plan Sponsors

DC Plan Sponsors

Case Study

The Journal of Portfolio Management

has published applied research on portfolio valuation at UC Investments.

has published applied research on portfolio valuation at UC Investments.

Read "Innovation in Valuation" As cited by the World Economic Forum and others

Case Study

The Journal of Portfolio Management

has published applied research on portfolio valuation at UC Investments.

has published applied research on portfolio valuation at UC Investments.

Case Study

The Journal of Portfolio Management has published applied research on portfolio valuation at UC Investments.

Investing In Growth and Skill

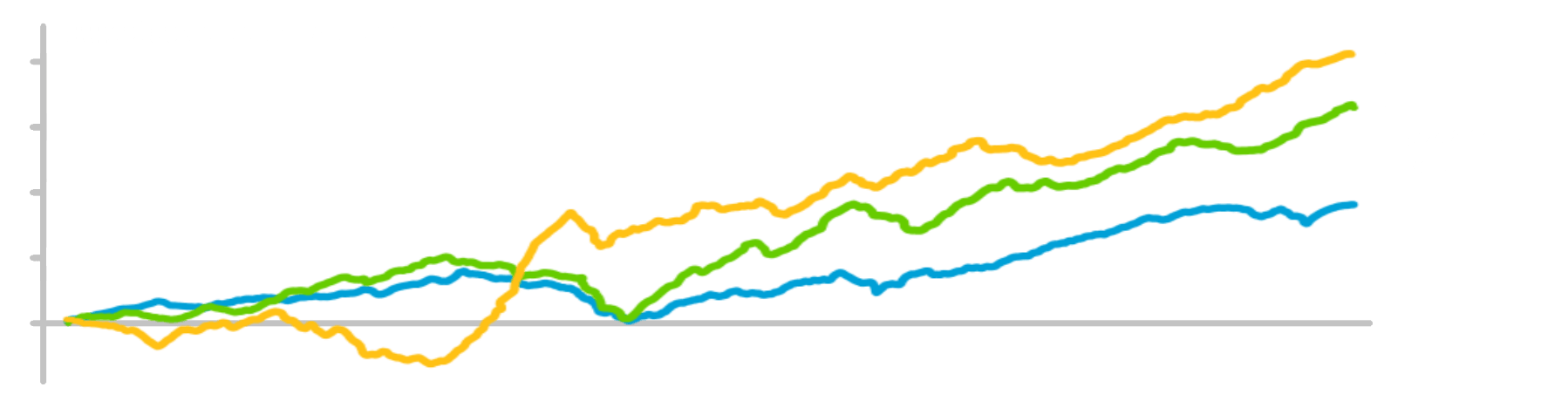

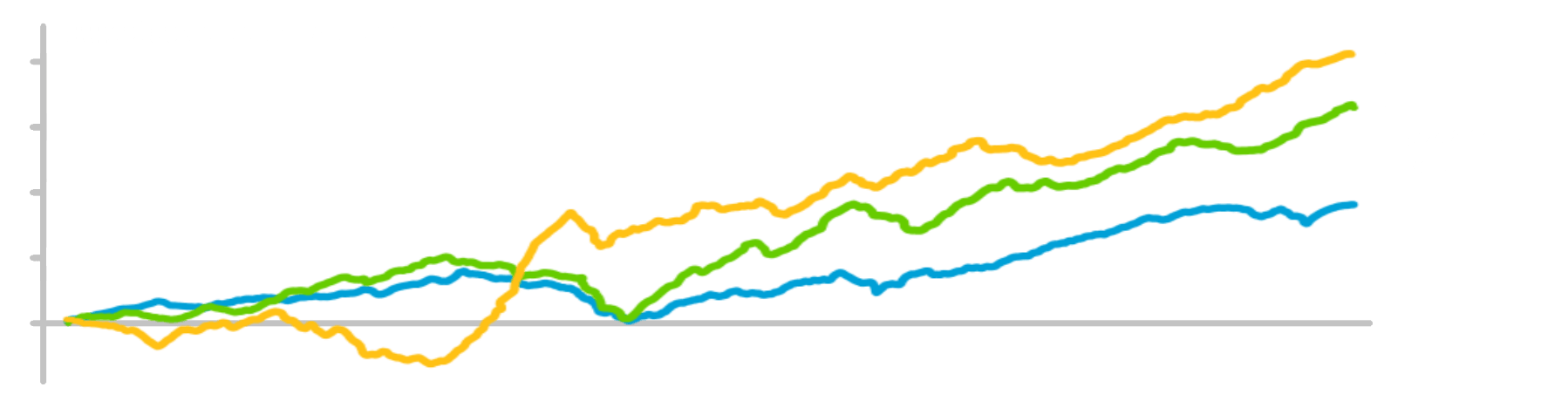

Fundamental growth and manager skill are highly prized, but notoriously difficult to quantify and compare.

State-of-the-art performance evaluation solutions solve this problem.

In formats customizable to fit seamlessly into your processes,gain rigorous, repeatable measures of returns, excess returns, and attribution of excess returns by company, fund, deal team and/or manager.

Go to OPX Manager Evaluation Solutions

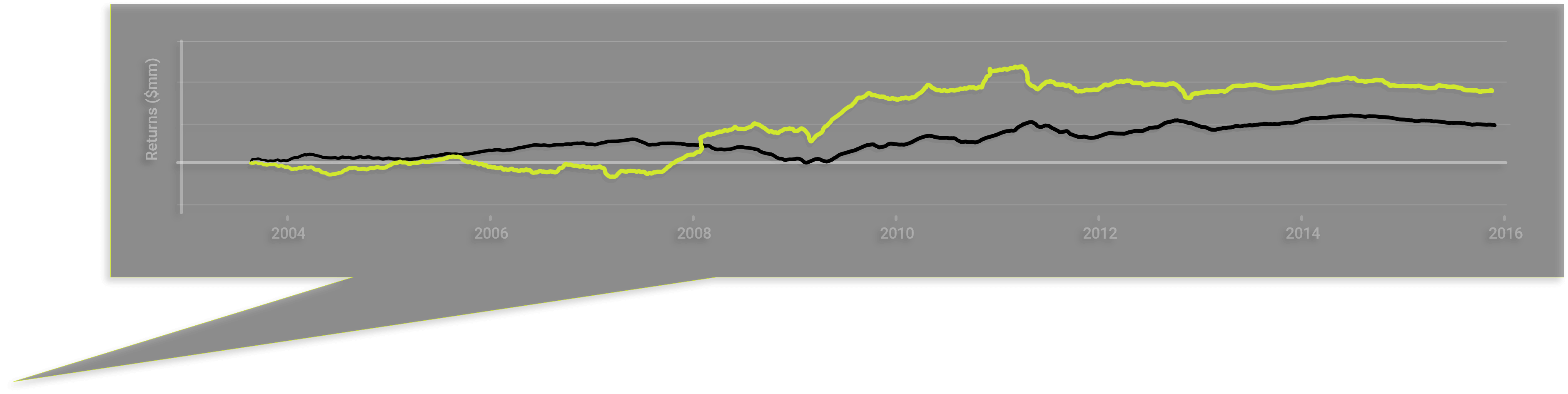

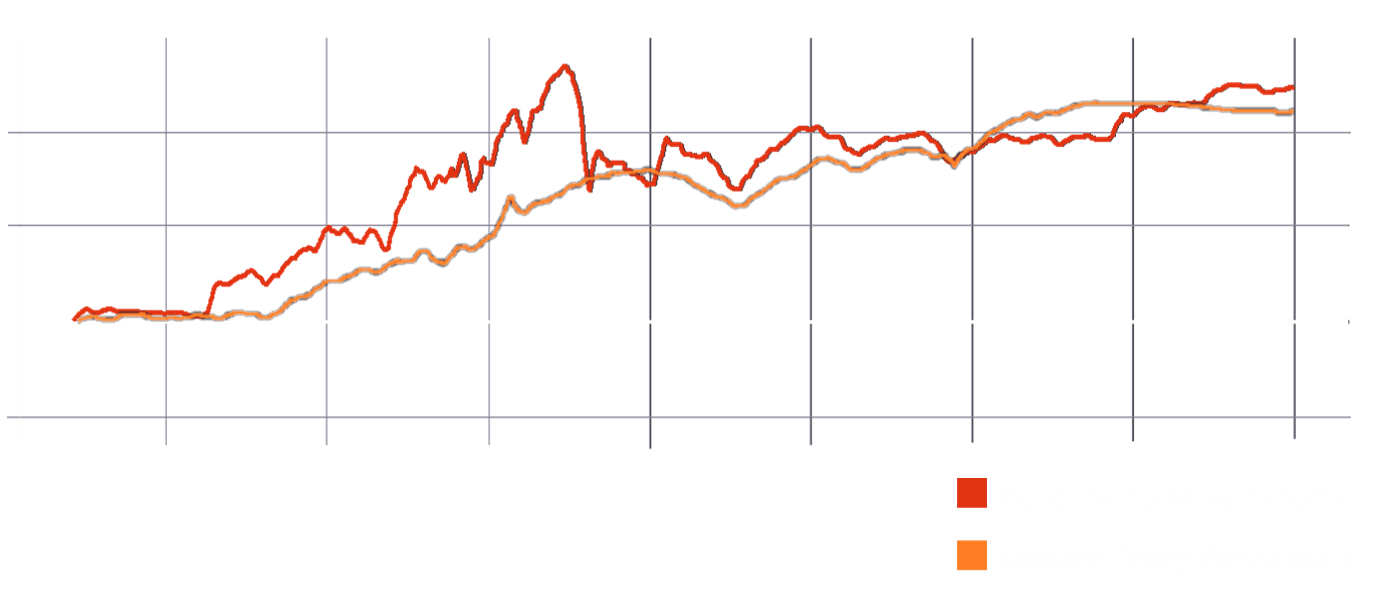

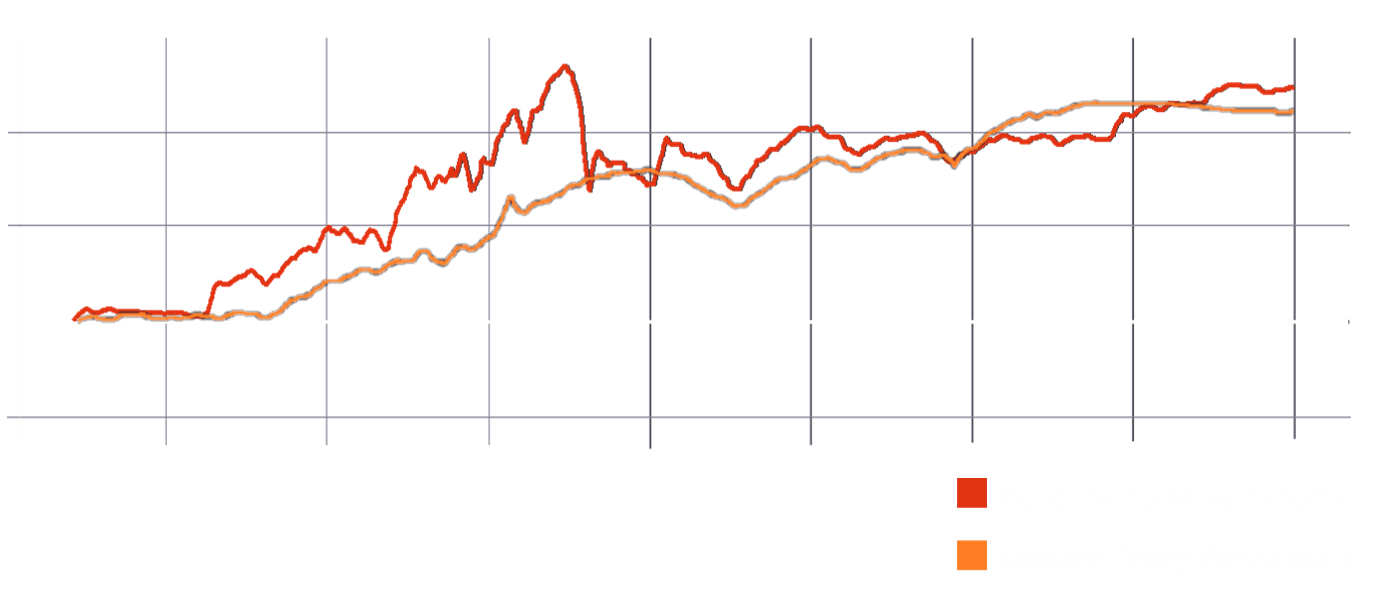

Cumulative Time-Weighted Returns of Companies,

Rolled Up To The Fund,

With Their Rolled Up Modern Proxy Benchmarks

Rolled Up To The Fund,

With Their Rolled Up Modern Proxy Benchmarks

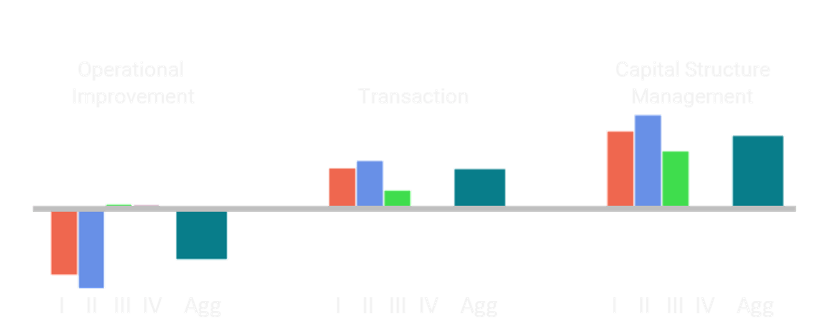

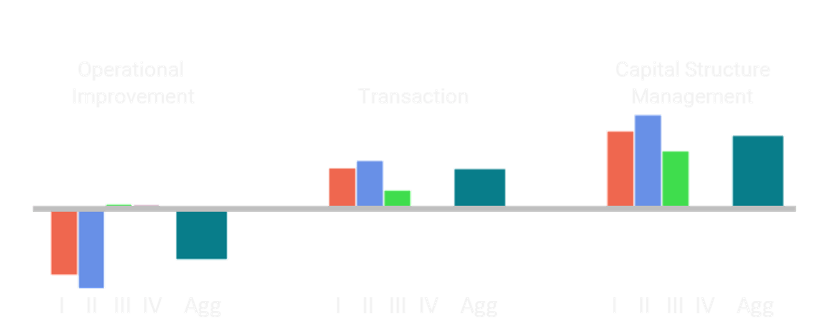

Quantification of Manager Contribution

to Excess Returns and its Attribution to

Source of Value by Company, Fund and Manager

to Excess Returns and its Attribution to

Source of Value by Company, Fund and Manager

Investing In Growth

and Skill

and Skill

Fundamental growth and manager skill are highly prized, but notoriously difficult to quantify and compare.

State-of-the-art performance evaluation solutions solve this problem.

In formats customizable to fit seamlessly into your processes, gain rigorous, repeatable measures of returns, excess returns, and attribution of excess returns by company, fund, deal team and/or manager.

Cumulative Time-Weighted Returns of Companies, Rolled Up to the Fund, with their Rolled Up Modern Proxy Benchmarks

Quantification of manager contribution to outperformance and its attribution to source of value by company, fund, and manager

OPX Manager Evaluation Solutions

Valuation as Scalable Infrastructure

Breakthrough Properties of FEV Technology

0.87

R2 TO EXIT VALUE

Accurate

High accuracy to defined targets make an extensible array of processes possible and more informative.

FULL

AUTOMATION

ISO Compliant

Codified continuous improvement and automated testing ensures analytics evolve along with the portfolio and the market.

Repeatable

Connects asset fundamentals systematically to the market using no discretionary inputs.

100%

OBJECTIVE

Fast

Technology efficiencies take computationally intensive processes reliably into the daily environment.

90,000

ASSETS MEASURED IN

˂90

SECONDS

Valuation as Scalable Infrastructure

Breakthrough Properties of FEV Technology

0.87

R2 TO EXIT VALUE

Accurate

High accuracy to defined targets make an extensible array of processes possible and more informative.

Fast

Technology efficiencies take computationally intensive processes reliably into the daily environment.

90,000

ASSETS MEASURED IN

˂90

SECONDS

100%

OBJECTIVE

Repeatable

Connects asset fundamentals systematically to the market using

no discretionary inputs.

no discretionary inputs.

ISO Compliant

Codified continuous improvement automate testing ensures analytics evolve along with the portfolio and the market.

FULL

AUTOMATION

Valuation as Scalable Infrastructure

Breakthrough Properties

of FEV Technology

of FEV Technology

0.87

R2 TO EXIT VALUE

Accurate

High accuracy to defined targets make an extensible array of processes possible and more informative.

Fast

Technology efficiencies take computationally intensive processes reliably into the daily environment.

90,000

ASSETS MEASURED IN

˂90

SECONDS

100%

OBJECTIVE

Repeatable

Connects asset fundamentals systematically to the market using no discretionary inputs.

ISO Compliant

Codified continuous improvement and automated testing ensures analytics evolve along with the portfolio and the market.

FULL

AUTOMATION

the science

Systematic quantification of a company's size.

Informed intelligently by the markets daily.

Enhanced valuation and performance metrics.

Our science targets and resolves core structural issues

that waste billions and limit the industry.

that waste billions and limit the industry.

the science

A systematic quantification of a company's size.

Informed intelligently by the markets daily.

Enhanced valuation and performance metrics.

Our science targets and resolves core structural issues

that waste billions and limit the industry.

that waste billions and limit the industry.

the science

A systematic quantification of a company's size.

Informed intelligently by the markets daily.

Enhanced valuation and performance metrics.

Our science targets and resolves core structural issues

that waste billions and limit the industry.

that waste billions and limit the industry.

research and insights

Published Research

What's in a better benchmark? Actually, a manager's skill.

Benchmark-Based Attribution in PE, in Journal of Financial Data Science

Critical Thinking

Theoretical deficiencies in private equity's "value bridge" approach to performance attribution.

A Concise, Need-to-Know Analysis

case study

Fine-tuning liquidity management: no lag and more frequent valuations.

Innovation in Valuation, in The Journal of Portfolio Management

research and insights

Published Research

What's in a better benchmark? Actually, a manager's skill.

Benchmark-Based Attribution in PE, in Journal of Financial Data Science

Critical Thinking

Theoretical deficiencies in private equity's "value bridge" approach to performance attribution.

A Concise, Need-to-Know Analysis

case study

Fine-tuning liquidity management: no lag and more frequent valuations.

Innovation in Valuation, in The Journal of Portfolio Management