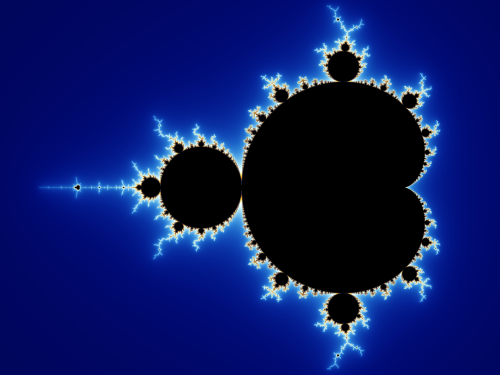

Do fractal patterns play a role in business growth, and can they provide managers and investors with insight into the mechanics of how companies actually grow? FEV Analytics has found new evidence that suggests “yes.”

FEV Analytics research has uncovered evidence of distinct interacting fractal patterns in business growth. At various stages of growth, different patterns wax and wane in their influence on company growth (measured by business market value). These patterns may provide a better understanding of growth and non-growth in businesses.

The discovery of fractal behavior in business growth has been an almost accidental byproduct of FEV Analytics implementation and validation of an empirical estimator of private company value and risk.

After developing a valuation model based on huge amounts of real-world data, the company discovered that the underlying mathematics has properties typically associated with fractals. Specifically, functions underlying the model are self-affine and exhibit non-integer dimensionality, attributes that point to the existence of fractal kinetics in company growth. Further investigation indicates that the form and relative importance of these patterns varies by industry and growth stage.

Fractal theory has been applied in fields such as neuroscience, biology and pathology to explain natural growth patterns. Will fractal mathematics also contribute to improving business value?

Future installments will explore the evidence and practical applications of fractal patterns in business growth.